Market Overview

The Vietnamese open-ended fund market recorded positive momentum in July 2025, with growth in assets under management (AUM), net inflows, and the number of investors. This reflects growing confidence in open-ended funds as a transparent and long-term investment channel.

- Total active open-ended funds: 69

- 37 Equity funds

- 23 Bond funds

- 9 Balanced funds

- Total AUM: VND 61,479.23 billion, an increase of VND 3,174 billion compared to June.

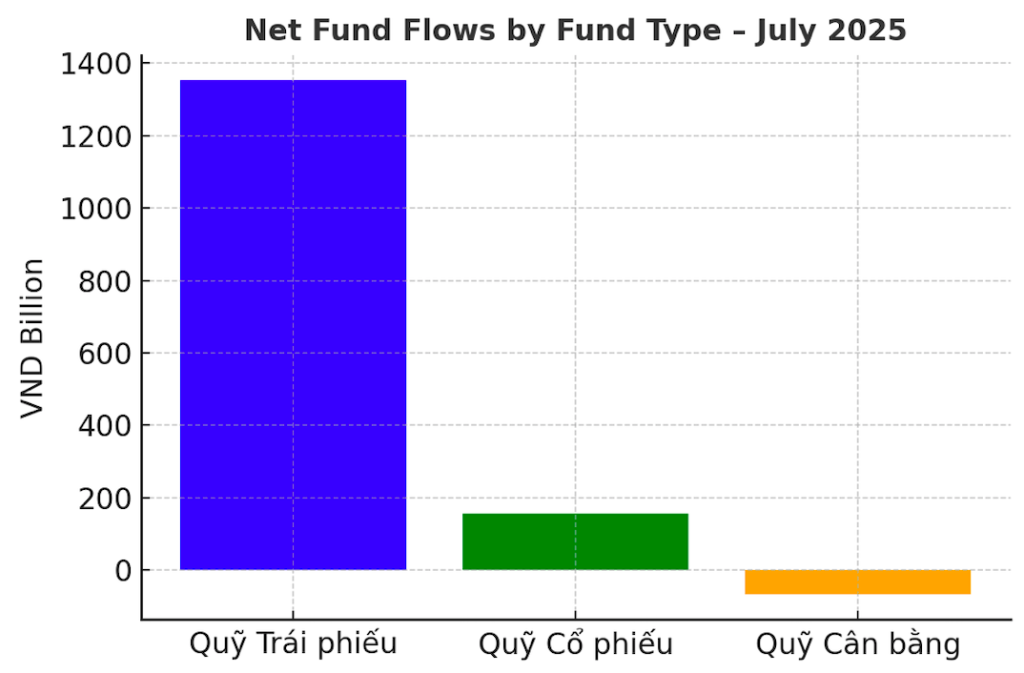

- Net inflows (fundflow): VND 1,444.7 billion

- Bond funds: +1,352 billion (largest share)

- Equity funds: +157 billion

- Balanced funds: -65.6 billion (net outflow)

- Total number of fund investors: 470,000

These figures show that bond funds remain the most favored category, while equity funds are also attracting new inflows thanks to improving stock market sentiment.

Performance of Open-ended Funds in July 2025

Investment performance in July showed clear divergence among fund categories, with equity funds taking the lead.

Top 5 Best-performing Funds

- TCFIN (Techcom Capital – Equity): +16.33%

- LHBF (Lighthouse FMC – Bond): +13.11%

- FVEF (FIDES FMC – Equity): +12.43%

- BVFED (Baoviet Capital – Equity): +11.00%

- VFMVSF (Dragon Capital – Equity): +10.51%

Equity funds dominated the top performers, with TCFIN delivering the strongest gain of +16.33%. Surprisingly, LHBF bond fund also posted an impressive +13.11%, significantly outperforming most peers in the fixed-income category.

Top 5 Worst-performing Funds

- PBIF (PVCombank Capital – Balanced): -17.76%

- TCGF (ThanhCong FMC – Equity): -12.07%

- TCBF (Techcom Capital – Bond): -4.78%

- PVBF (PVCombank Capital – Bond): -3.46%

- VESAF (VinaCapital – Equity): -1.74%

The balanced fund category showed the highest volatility, with PBIF posting the steepest decline (-17.76%). Some equity and bond funds also experienced significant drawdowns.

Performance by Fund Type

- Equity funds: Delivered the strongest overall results, with several funds gaining over 10%. However, performance divergence was high, with some funds facing double-digit losses.

- Bond funds: Most funds posted modest positive returns (0.3% – 2.5%), except for LHBF which surged +13.11%. This reflects the effectiveness of active portfolio management.

- Balanced funds: Showed the widest dispersion, ranging from positive returns of ~+5% (ENF, VCAMBF) to the largest loss in the market (PBIF -17.76%).

Outlook for Vietnam’s Open-ended Fund Market

- Fund flow trends: Bond funds remain the top choice thanks to their stability and resilience.

- Equity funds: Strong performance in July suggests further inflows, especially if the VN-Index maintains its upward trend.

- Balanced funds: Require better portfolio strategies to reduce risks and avoid excessive volatility.

With expanding AUM and a growing investor base, Vietnam’s open-ended fund market is on track for sustainable long-term growth, consolidating its role as a reliable investment channel.