The Concept of “Reciprocal Taxation”

“Reciprocal taxation” refers to a mechanism within the tax system in which taxpayers not only bear financial obligations but also receive tangible value and benefits from the state. The fundamental idea behind this model is to create a balance between the tax burden and the public services that individuals and businesses enjoy, ensuring that every tax dollar collected is reinvested into key sectors such as:

Infrastructure: Building and maintaining roads, bridges, and public transportation systems to strengthen regional economic connectivity.

Healthcare and Education: Enhancing the quality and accessibility of healthcare and education services for the community.

Security and Public Safety: Providing police, fire protection, and other measures to safeguard social order.

Other Public Utilities: Supporting social housing programs, environmental protection, and various social welfare initiatives.

This approach emphasizes that taxation is not merely a cost to citizens and businesses, but also a means of securing sustainable development and social well-being.

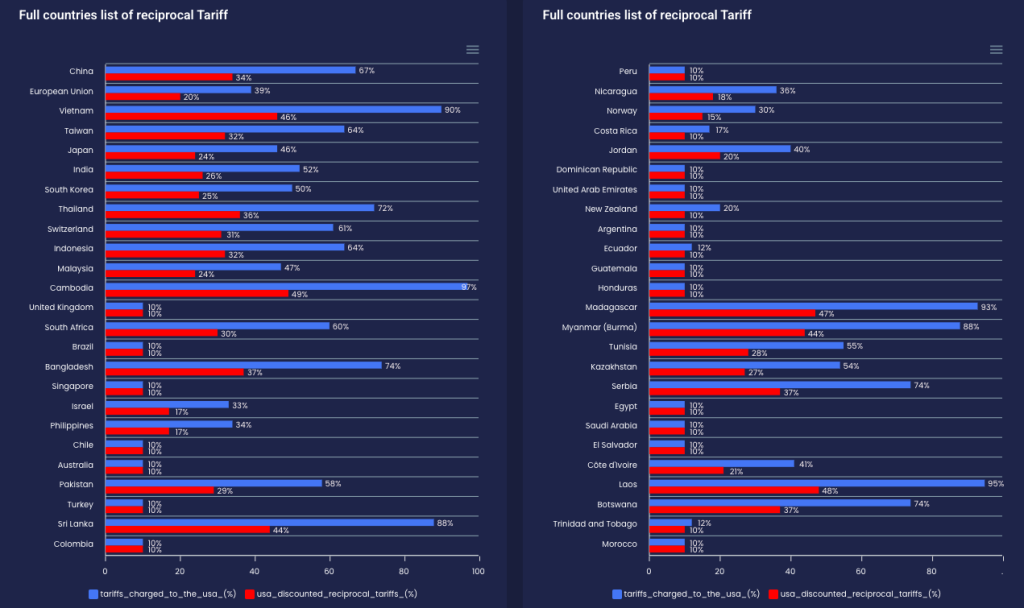

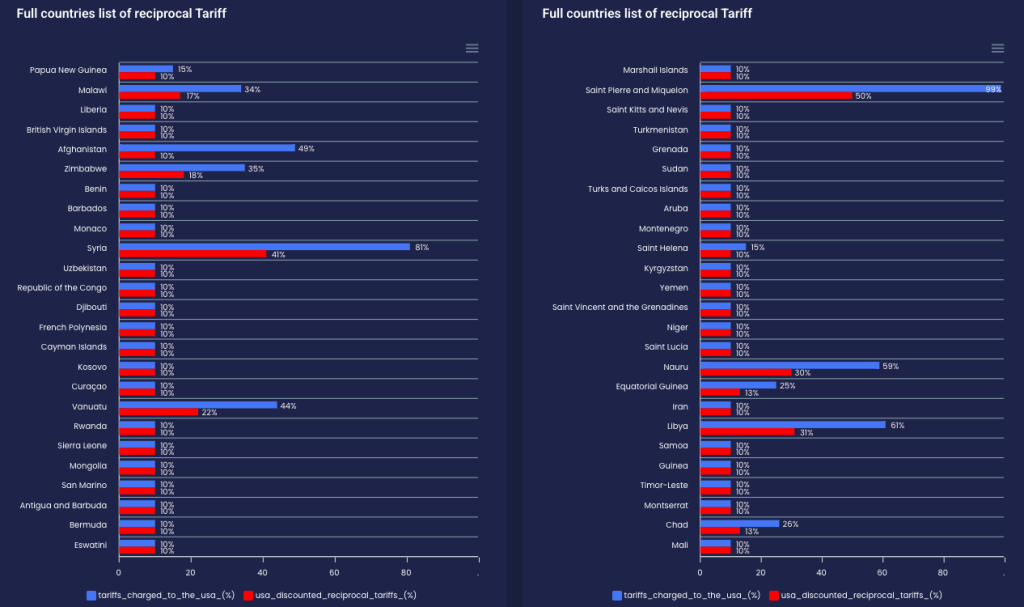

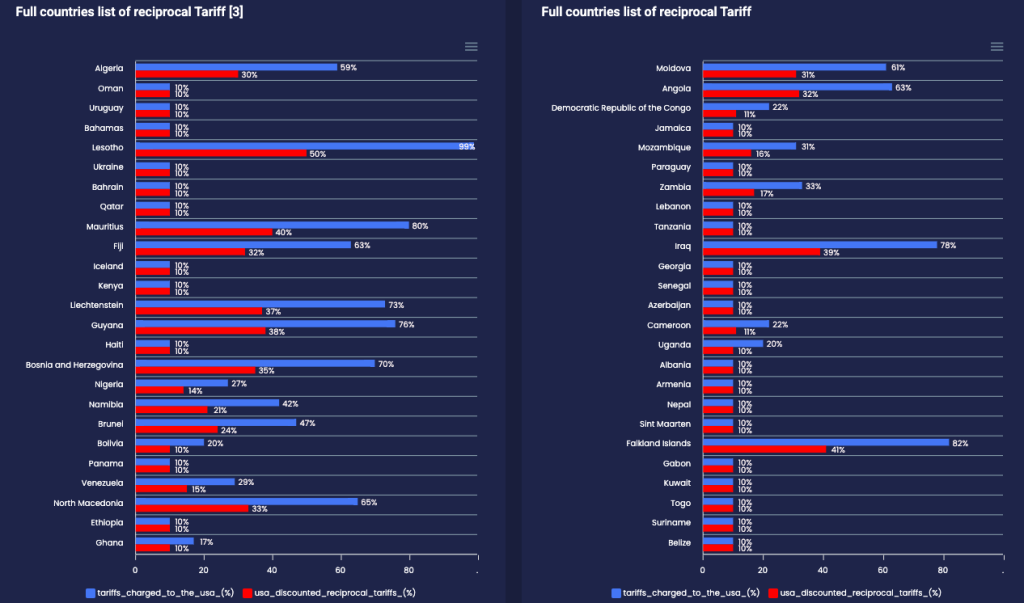

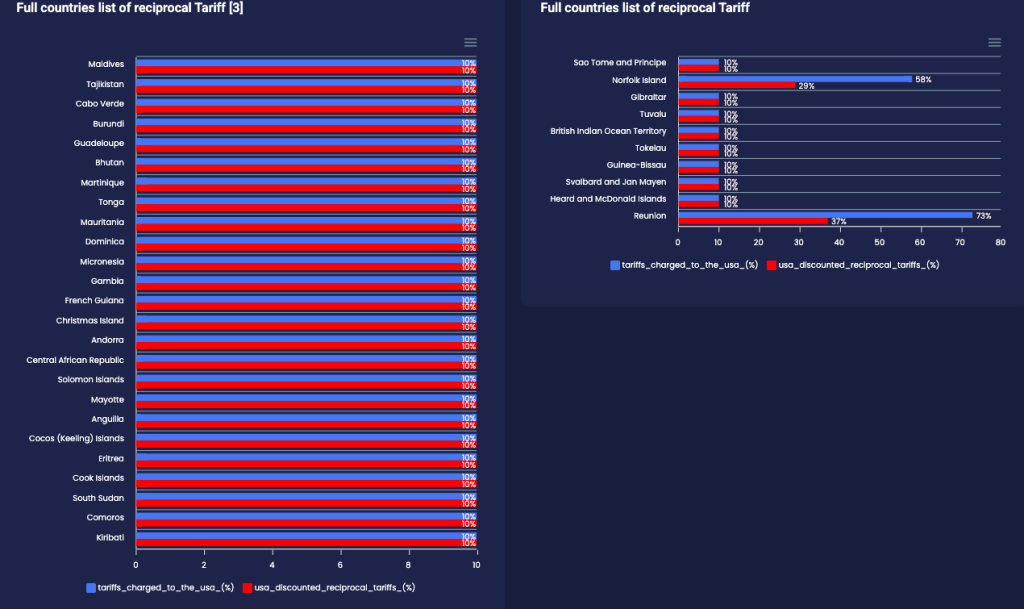

Download here tariffs