Open-End Fund Distribution Management Dashboard

The Open-End Fund Dashboard is a powerful tool designed to support distribution agents in analyzing the market and selecting the most suitable mutual fund products for their clients.

With this dashboard, fund advisors can easily access updated information on fund performance, profitability, and portfolio composition of the funds chosen by their clients. A wide range of indicators is provided, enabling clients to select the right fund that aligns with their investment objectives and risk tolerance.

Providing the most suitable fund recommendations is essential not only for enhancing customer loyalty but also for building trust and credibility for fund advisors.

In addition, to minimize potential losses during market volatility, it is crucial for fund advisors to thoroughly review market reports and research insights before making recommendations to clients. This ensures that advice is well-informed, timely, and aligned with investor needs.

Open-End Fund Distribution Management Dashboard

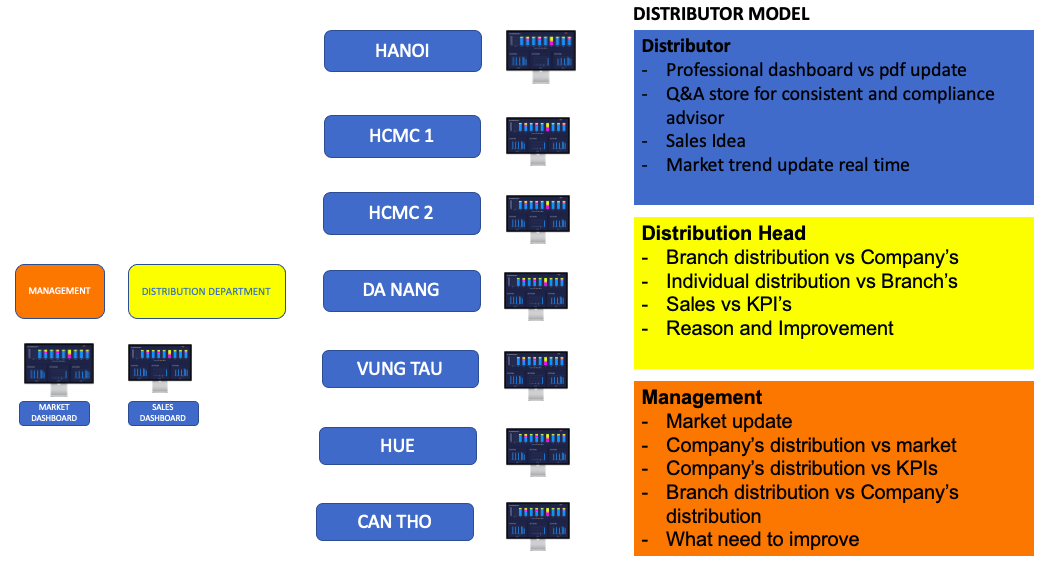

The Open-End Fund Distribution Management Dashboard is designed to enhance operational efficiency for fund managers, distribution agents, and financial advisors, while building greater trust among clients in selecting suitable investment products.

This dashboard enables comprehensive analysis of distribution performance across multiple branches, provinces, or regions, providing valuable insights into the effectiveness of fund sales channels. Advisors gain real-time access to fund performance results, investor behavior, and market trends anytime, anywhere.

More importantly, the market dashboard helps answer critical questions, such as why investors are redeeming, why investment values fluctuate, and other key issues that impact fund performance and investor confidence.

For example, through the dashboard, management teams can quickly identify which branches are meeting KPI targets and which are underperforming, along with the underlying reasons—whether it be advisors failing to follow up with clients, a shortage of potential leads, or other factors. With these insights, fund managers and distribution leaders can adjust strategies promptly to improve outcomes.

By delivering transparency, actionable insights, and real-time analytics, the Open-End Fund Distribution Management Dashboard empowers organizations to optimize operations, strengthen client relationships, and achieve sustainable growth in the competitive investment market.

Key Functions of the Fund Distribution Management Dashboard

The Fund Distribution Management Dashboard is designed to provide comprehensive insights and real-time monitoring, empowering fund managers, distribution agents, and advisors to optimize their operations and strengthen investor relationships.

Core Functions

Real-Time Investment Analysis: Track fund performance, monitor total assets under management (AUM) growth, and observe investor holding patterns in real time.

Cash Flow Tracking: Identify which fund categories are attracting new inflows and which are facing redemptions, enabling proactive strategy adjustments.

Cross-Asset Return Updates: Stay informed with updated performance comparisons across alternative investment channels such as gold, bank deposits, equities, and bonds.

Knowledge Sharing Across Branches: Facilitate collaboration by sharing frequently asked client questions (Q&A) among different distribution branches, helping advisors provide more consistent and effective client support.

By integrating these features, the dashboard empowers organizations to gain deeper market insights, improve client advisory, and enhance overall efficiency in fund distribution.